#Streamlined Billing Process

Explore tagged Tumblr posts

Text

https://www.acuitilabs.com/media/

#AcuitiMedia#Usage-Based Billing Solution#Media and Entertainment Industry#SAP Billing#Digital Transformation for Media#Subscription Management#Pre-Pay and Post-Pay Billing#Revenue and Innovations Management#SAP BRIM Accelerator#Acuiti Labs#Media Industry Technology#Enhancing Customer Experience#Streamlined Billing Process

1 note

·

View note

Text

How AR Outsourcing Future-Proofs Business Cash Flow

As businesses grow, so do their financial complexities. One area that often becomes a bottleneck is managing customer payments efficiently. That’s where accounts receivable outsourcing proves to be a game-changer. It enables companies to focus on growth while experienced professionals handle the receivables process with precision and consistency.

By partnering with reliable AR outsourcing services, businesses gain access to skilled teams who specialize in collecting payments, reducing delays, and improving customer communication. This not only shortens the cash conversion cycle but also significantly improves accuracy and compliance.

Another major advantage of outsourcing accounts receivable is cost-efficiency. Maintaining an in-house AR team requires investment in staff, training, and technology. In contrast, outsourcing provides cost-effective finance solutions that reduce overhead while delivering better results.

Outsourced providers also help streamline billing processes through automation and digital tools. This reduces manual errors, speeds up invoicing, and ensures timely follow-ups. As a result, businesses see fewer disputes, faster payments, and improved cash flow.

Ultimately, the benefits of outsourcing accounts receivable extend beyond just financial gains. It empowers businesses to operate more efficiently, scale operations smoothly, and maintain stronger relationships with their clients by offering a more professional and responsive billing experience.

In a dynamic business environment, smart financial decisions can define success. Choosing accounts receivable outsourcing is not just a cost-saving tactic—it’s a strategic move toward sustainable growth and operational excellence.

#accounts receivable outsourcing#AR outsourcing services#benefits of outsourcing accounts receivable#cost-effective finance solutions#streamline billing process

0 notes

Text

Effective Accounts Receivable (AR) management is crucial for home health providers to maintain financial stability and ensure consistent revenue. One way to streamline this process is by utilizing healthcare billing services nationwide, which help organizations manage the complexities of billing, coding, and collections. These services ensure that claims are filed correctly and payments are received on time, preventing financial strain.

0 notes

Text

Optimizing Financial Management with Chiropractic Billing Services

In the healthcare sector, chiropractic care plays a vital role in managing musculoskeletal conditions, improving mobility, and enhancing patients' overall quality of life. However, managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments, frequent patient visits, and varying insurance policies. This is where medical billing services come into play, ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline the billing process, minimize errors, and enhance reimbursement rates, which ultimately leads to better revenue management for chiropractic practices.

What Are Chiropractic Billing Services?

Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These services are a critical component of Revenue Cycle Management (RCM) services, which oversee the entire process of patient billing, from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiropractic adjustments to following up on claims and managing denials. Since chiropractic care often involves ongoing treatments and multiple patient visits, these billing services ensure that claims are submitted accurately and promptly, reducing delays and maximizing revenue.

The Importance of Medical Billing and Coding in Chiropractic Care

Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provide. Chiropractic care involves various treatments, such as spinal adjustments, physical therapy, and other therapeutic services, each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments, which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing and coding, chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards, leading to improved financial outcomes.

Benefits of Healthcare IT in Chiropractic Billing

In the digital age, Healthcare IT has transformed the way billing services are managed, offering numerous benefits for chiropractic practices. Advanced billing software and electronic health record (EHR) systems streamline the billing process by automating tasks such as claim submission, coding, and patient record management. Healthcare IT reduces human error, speeds up payment cycles, and allows for better communication between chiropractic providers and insurance companies. Additionally, real-time tracking and reporting features enable chiropractic practices to monitor the status of claims and payments, ensuring that revenue is managed efficiently. Healthcare IT enhances both the accuracy and efficiency of chiropractic billing, leading to improved practice operations.

Chiropractic Billing Services at Mediclaim Management

Mediclaim Management offers specialized Chiropractic Billing Services designed to meet the needs of chiropractic practices. With a deep understanding of the unique challenges that chiropractors face, their team of billing experts ensures that all aspects of the billing process are handled with precision and care. Mediclaim Management’s Chiropractic Billing Services help providers reduce billing errors, increase claim approval rates, and expedite reimbursements. By partnering with Mediclaim Management, chiropractic practices can focus on delivering high-quality care to their patients while ensuring that their financial operations run smoothly in the background.

With Mediclaim Management’s Chiropractic Billing Services, chiropractic providers can optimize their revenue cycle, reduce financial stress, and ensure that their practice remains financially healthy. This allows chiropractors to focus on what truly matters—improving the health and well-being of their patients.

#medical billing#Optimizing Financial Management with Chiropractic Billing Services#In the healthcare sector#chiropractic care plays a vital role in managing musculoskeletal conditions#improving mobility#and enhancing patients' overall quality of life. However#managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments#frequent patient visits#and varying insurance policies. This is where medical billing services come into play#ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline t#minimize errors#and enhance reimbursement rates#which ultimately leads to better revenue management for chiropractic practices.#What Are Chiropractic Billing Services?#Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These servic#which oversee the entire process of patient billing#from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiroprac#these billing services ensure that claims are submitted accurately and promptly#reducing delays and maximizing revenue.#The Importance of Medical Billing and Coding in Chiropractic Care#Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provi#such as spinal adjustments#physical therapy#and other therapeutic services#each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments#which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing#chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards#leading to improved financial outcomes.#Benefits of Healthcare IT in Chiropractic Billing#In the digital age

0 notes

Text

Top Healthcare Management Consultancy

Healthcare Consultancy for Work Comp, Billing & More!

Looking for expert guidance in healthcare management? Agima Medical Management is here to help!

Our consultancy services specialize in work comp, billing, and more.

Let us streamline your processes and maximize your efficiency. Contact us today for a consultation!

#Healthcare Consultancy#Billing System#Streamline Process#Work Comp Management#Agima Medical Management

0 notes

Text

"Across religions of all creeds and sects, there’s a unifying theme of helping one’s neighbors — and that’s a mission that pastor Michael Jones wants to prioritize for his community in the coming years.

Recently, Jones’ Village of Faith Ministries, a church based in Sandston, Virginia, joined congregations around the country in converting church property into affordable housing.

“We knew that, at some point in time, we would look to position ourselves to sell a portion of it, or all of it, to simply aid where our congregation is trying to go in the future,” Jones told Next City in January.

The church is presently eying a portion of its 1.5 acre property on its Southside location with plans to construct 192 apartments and 40 townhomes.

Jones told Next City that the homebuilding company D.R. Horton worked with the church to develop a housing plan that could meet the church’s financial goals while also keeping rent costs low.

“We know that housing is a need,” Jones said.

Jones sees a bright future for the 232 housing units yet to be built, and the 232 families that will call their property home.

Jones wants the church to be a community hub, where people can seek services, meet their neighbors, and even visit the community garden on its property.

“Our churches should not be vacant Monday through Saturday,” Jones said.

Village of Faith Ministries joins a growing number of faith-based organizations that are addressing the housing crisis in a variety of ways, whether it’s by building tiny home communities for the homeless, offering zero interest loans for low-income families, or extending rental assistance to those in need.

In response to cynicism surrounding new housing developments — often boiled down to the phrase “not in my backyard” — churches across the United States started the faith-based movement: “Yes, In God’s Backyard.”

The grassroots effort works to address the nationwide deficit of affordable housing and inspire faith leaders to use their resources to give back to their communities.

And it’s working.

Last year, a bill titled “Yes, In God’s Backyard” passed in California, which permits religious institutions to convert their land into housing without being held to local zoning regulations.

In early 2025, Virginia’s state senate considered a similar bill, “Faith in Housing for the Commonwealth” — a bill that was still under review at the time of publication.

“[We proudly support the] ‘Faith in Housing for the Commonwealth Act’ to build more affordable housing where it is most needed by allowing churches to build affordable housing on their land through a streamlined process,” the Commonwealth Housing Coalition said in a press statement.

“Today in Virginia, too many of our neighbors and community members struggle to afford a place to call home,” the coalition continued. “We have an opportunity to help more faith-based institutions help solve this problem by allowing them to build homes on their land.”"

-via GoodGoodGood, March 12, 2025

#church#virginia#united states#north america#housing#housing crisis#christianity#affordable housing#good news#hope

924 notes

·

View notes

Text

★ financial guide for the rising signs [2nd, 6th, 10th] ★

★ aries rising ★

your financial success is built on consistency and long-term stability, not quick wins. with taurus ruling your 2nd house, money grows when you treat wealth like a garden, planting seeds that will pay off over time. you thrive financially when you own assets, build slow but steady income streams, and develop financial patience. stop chasing instant gratification—your wealth is strongest when it’s rooted in something tangible. luxury and financial comfort are meant for you, but you have to build them brick by brick.

your 6th house in virgo makes you a high-efficiency worker, someone who functions best when there’s structure, organization, and refinement. you make money by perfecting a craft, streamlining processes, and offering exceptional value. your best financial move is to create a system that allows you to scale your work efficiently. you’re at your worst when you’re working aimlessly without a clear financial plan.

your 10th house in capricorn means you were born to lead, build, and accumulate wealth over time. you’re meant for legacy careers, business ownership, and high-status roles. people respect you when you take charge, so stop underpricing yourself or playing small.

how to make money effectively:

develop long-term wealth strategies—real estate, investments, high-end services

charge premium rates for expertise and reputation

create a financial structure that supports stability

what to avoid:

chasing quick, unstable money

overworking without a strategy

switching careers before establishing mastery

★ taurus rising ★

your financial power is in communication, adaptability, and multiple income streams. with gemini ruling your 2nd house, money flows to you when you leverage your voice, ideas, and connections. financial success doesn’t come from routine—it comes from diversity in income sources. you are meant to write, teach, sell, or speak your way into wealth. the more financial channels you open, the more money circulates to you.

your 6th house in libra means you work best in aesthetic, harmonious, and collaborative environments. you aren’t built for chaotic, high-stress jobs. you thrive in team settings, networking-based careers, and industries that blend beauty with logic. financial stability comes when you learn to balance your workload instead of overextending yourself.

your 10th house in aquarius demands an unconventional, tech-forward career path. you are meant to break traditional job structures, innovate, and align with futuristic industries. you do best in digital entrepreneurship, social media, trend forecasting, or anything that involves forward-thinking ideas.

how to make money effectively:

monetize your ability to communicate and teach

build multiple income streams—investments, digital products, freelancing

work in tech, media, or networking-heavy industries

what to avoid:

relying on one static job

working in environments that lack creativity

ignoring opportunities in digital markets

★ gemini rising ★

your wealth is deeply emotional, tied to security, intuition, and financial comfort. with cancer in your 2nd house, money doesn’t just pay the bills—it makes you feel safe, nurtured, and at home. your income thrives when you create financial stability through consistent cash flow, savings, and emotional alignment. financial stress deeply affects you, so it’s essential to prioritize steady income rather than risky financial ventures.

your 6th house in scorpio makes you a deep, obsessive worker. you aren’t interested in shallow or meaningless tasks—you work best when you’re fully immersed in something that feels powerful. your financial strength comes from mastering hidden knowledge, psychology, finance, or investigative work.

your 10th house in pisces means your career should be intuitive, creative, or healing-based. you excel in spirituality, psychology, creative arts, or behind-the-scenes industries. your wealth is strongest when you trust your intuition in financial decisions and align with work that feels meaningful.

how to make money effectively:

build a secure financial base to reduce stress

monetize your intuition, creativity, or depth of knowledge

work in psychology, spirituality, creative arts, or research fields

what to avoid:

taking jobs that feel emotionally unfulfilling

working in environments that lack depth or purpose

ignoring financial planning and relying on instinct alone

★ cancer rising ★

your financial success is built on self-worth, confidence, and personal branding. with leo ruling your 2nd house, money flows when you own your value, embrace leadership, and position yourself as someone who deserves high earnings. you don’t attract wealth through small, quiet roles—you thrive when you command attention and make bold financial moves. underpricing yourself or working behind the scenes limits your wealth potential. financial success comes when you set premium rates, build a reputation, and confidently market yourself.

your 6th house in sagittarius means you work best in free-flowing, exploratory environments. you’re not designed for strict routines or micromanagement—you need variety, freedom, and adventure in your work. you thrive when you’re constantly learning, traveling, or expanding your knowledge.

your 10th house in aries makes you a self-made success. you aren’t meant to follow a traditional career path—you’re supposed to take risks, initiate projects, and carve your own way. your professional reputation grows when you move fast, innovate, and trust yourself to lead.

how to make money effectively:

charge higher prices and position yourself as an expert

monetize your personal brand, leadership skills, and visibility

choose work that offers freedom, travel, and expansion

what to avoid:

waiting for permission or validation before taking financial risks

settling for low-paying jobs that don’t challenge you

forcing yourself into structured, routine-based work

★ leo rising ★

your financial success is built on precision, planning, and efficiency. with virgo in your 2nd house, money comes when you treat your finances like a system—organized, methodical, and structured. you thrive when you budget carefully, invest in skill-building, and refine your financial strategy. spontaneous spending or reckless investments disrupt your natural wealth flow. success happens when you track income meticulously and build sustainable wealth through careful management.

your 6th house in capricorn makes you a relentless worker. you have an intense work ethic, but you need to ensure that your effort leads to long-term success rather than just grinding for survival. your wealth expands when you commit to one field and steadily rise through the ranks.

your 10th house in taurus means your career should be stable, luxurious, and built for long-term wealth. you are meant to own property, invest in high-end businesses, or work in industries that prioritize security and financial stability.

how to make money effectively:

build financial routines and long-term wealth strategies

focus on high-quality work that leads to reputation and authority

invest in tangible wealth like property, luxury markets, and stable industries

what to avoid:

working endlessly without a clear financial plan

undervaluing your expertise and meticulous skills

making impulsive financial choices instead of planning ahead

★ virgo rising ★

your financial success is tied to relationships, aesthetics, and social influence. with libra in your 2nd house, money flows when you use charm, partnerships, and artistic talents to generate wealth. your earning potential expands when you surround yourself with financially successful people and work in industries that blend beauty, balance, and intelligence.

your 6th house in aquarius means you work best in unconventional, flexible environments. you aren’t designed for traditional 9-to-5 jobs—you thrive when you can innovate, experiment, and work on your own terms. your wealth builds when you stay ahead of trends and tap into progressive industries.

your 10th house in gemini means your career should involve communication, education, and media. you excel when you’re writing, speaking, teaching, or sharing ideas with the public.

how to make money effectively:

leverage social connections, networking, and collaborations

work in aesthetic industries like fashion, branding, design, or public relations

monetize your voice, writing, or ability to share knowledge

what to avoid:

working in rigid, traditional jobs that limit your creativity

avoiding financial discussions or neglecting money management

sticking to one income source instead of diversifying

★ libra rising ★

your financial power is rooted in secrecy, transformation, and hidden wealth. with scorpio in your 2nd house, money isn’t just about earning—it’s about long-term accumulation, financial control, and strategic investments. you are meant to build private wealth, passive income, and financial independence through methods that aren’t obvious to others. your money grows when you invest wisely, keep your financial moves private, and create wealth that isn’t easily disrupted.

your 6th house in pisces makes you a fluid, intuitive worker. you function best when you can follow inspiration rather than rigid schedules. your work needs to feel meaningful, creative, or spiritually aligned.

your 10th house in cancer means your career should be emotionally connected, nurturing, and deeply fulfilling. you thrive in real estate, finance, healing professions, or work that allows you to support others.

how to make money effectively:

build passive income and long-term wealth strategies

work in finance, psychology, healing, or real estate

keep your financial success private—money grows best when protected from outside influence

what to avoid:

oversharing your financial plans before they manifest

choosing jobs that feel shallow or emotionally unfulfilling

avoiding money management out of fear of instability

★ scorpio rising ★

your financial success comes from expansion, risk-taking, and trusting your instincts. with sagittarius in your 2nd house, money doesn’t come through slow accumulation—it comes through big leaps, bold decisions, and aligned opportunities. financial growth happens when you invest in yourself, take strategic risks, and follow your gut on money matters.

your 6th house in aries makes you a fast-paced, action-driven worker. you work best when you can move quickly, make independent decisions, and avoid unnecessary bureaucracy.

your 10th house in leo means your career should be high-profile, leadership-based, and tied to personal recognition. you are meant to be seen, respected, and known for your achievements.

how to make money effectively:

take calculated financial risks—investments, entrepreneurship, or industry leadership

monetize your personal brand and leadership skills

position yourself in high-visibility roles where people trust your expertise

what to avoid:

playing small in low-status roles that don’t challenge you

waiting too long to take financial risks and expand

ignoring financial planning in favor of short-term wins

★ sagittarius rising ★

your financial success is built on discipline, long-term planning, and strategic wealth-building. with capricorn in your 2nd house, money doesn’t come from luck—it comes from calculated effort, financial responsibility, and structured income streams. you are meant to accumulate wealth slowly and steadily, focusing on stability over quick money. financial success happens when you treat money seriously, create structured goals, and build assets that appreciate over time.

your 6th house in taurus makes you a consistent, hardworking employee or business owner. you thrive in stable, predictable work environments where your effort compounds over time. financial success is strongest when you create a routine that guarantees steady progress toward your goals.

your 10th house in virgo means your career should be practical, analytical, and detail-oriented. you excel in careers that require precision, problem-solving, and a structured approach to success. your path to wealth involves mastering a craft, refining your skills, and gaining a reputation for reliability.

how to make money effectively:

build structured financial plans and investment portfolios

work in industries that reward consistency, expertise, and long-term strategy

create multiple revenue streams that grow over time

what to avoid:

relying on short-term gains instead of sustainable wealth-building

working in unstable jobs with no long-term potential

ignoring financial planning and delaying wealth accumulation

★ capricorn rising ★

your financial success is tied to innovation, technology, and unconventional wealth-building methods. with aquarius in your 2nd house, money flows when you break away from traditional financial structures and embrace modern, progressive income sources. your wealth isn’t built through slow accumulation—it’s built through disrupting old systems, networking, and staying ahead of trends. financial success happens when you embrace new industries, invest in digital business, and use social influence to expand your financial reach.

your 6th house in gemini makes you a multitasking, fast-paced worker. you thrive in careers that keep your mind engaged, allow for constant learning, and involve communication or technology. your best financial move is to build diverse income streams rather than relying on one job.

your 10th house in libra means your career should involve social connections, aesthetics, or partnership-based industries. you succeed when you leverage your ability to connect people, create beauty, or navigate business relationships effectively.

how to make money effectively:

invest in tech-driven businesses, digital markets, and networking opportunities

create flexible income streams that allow financial independence

work in industries that prioritize aesthetics, relationships, or innovation

what to avoid:

following outdated financial models instead of embracing new ones

working in rigid, creativity-stifling jobs

ignoring opportunities that involve social influence or technology

★ aquarius rising ★

your financial success is built on intuition, creativity, and fluid income streams. with pisces in your 2nd house, money flows to you when you trust your instincts, embrace imaginative work, and allow wealth to come to you rather than chasing it. you don’t follow traditional financial rules—you manifest wealth through subconscious alignment, creativity, and spiritual awareness. financial success happens when you remove limiting beliefs around money and let abundance flow naturally.

your 6th house in cancer makes you an emotionally driven worker. you function best when your job feels meaningful, nurturing, and deeply connected to your values. you can’t thrive in cold, impersonal workplaces—you need a work environment that feels supportive and emotionally fulfilling.

your 10th house in scorpio means your career should be deep, powerful, and transformative. you succeed in roles that involve research, healing, finance, or uncovering hidden knowledge.

how to make money effectively:

monetize your creativity, spirituality, or intuitive skills

create passive income streams that let money flow without constant effort

work in industries that involve healing, psychology, or artistic expression

what to avoid:

following strict financial plans that don’t align with your natural flow

working in emotionally draining jobs that don’t fulfill you

ignoring your natural ability to manifest wealth effortlessly

★ pisces rising ★

your financial success is built on bold action, independence, and high-energy decision-making. with aries in your 2nd house, money doesn’t come from waiting—it comes from taking risks, trusting your instincts, and constantly staying in motion. you don’t accumulate wealth through slow, careful planning—you build it by jumping on opportunities, acting fast, and believing in yourself. financial success happens when you take charge of your earnings and don’t hesitate to claim financial independence.

your 6th house in leo makes you a natural performer and leader in the workplace. you thrive in high-energy jobs where you can be recognized, admired, and rewarded for your hard work. your best financial move is to put yourself in visible positions where people trust and follow your expertise.

your 10th house in sagittarius means your career should involve travel, adventure, and continuous expansion. you succeed when you embrace new experiences, follow your passions, and take risks in your professional life.

how to make money effectively:

take bold financial risks that align with your instincts

build a personal brand that makes you stand out in your field

work in industries that offer freedom, independence, and high rewards

what to avoid:

hesitating too long before making financial decisions

staying in jobs that don’t allow you to be seen or recognized

ignoring your need for financial independence and self-driven success

★ book a reading ★ ★ masterlist 1 ★ ★ masterlist 2 ★

#astrology#astrology observations#astrology aspects#astro observations#2nd house#6th house#10th house

744 notes

·

View notes

Text

🎄💾🗓️ Day 4: Retrocomputing Advent Calendar - The DEC PDP-11! 🎄💾🗓️

Released by Digital Equipment Corporation in 1970, the PDP-11 was a 16-bit minicomputer known for its orthogonal instruction set, allowing flexible and efficient programming. It introduced a Unibus architecture, which streamlined data communication and helped revolutionize computer design, making hardware design more modular and scalable. The PDP-11 was important in developing operating systems, including the early versions of UNIX. The PDP-11 was the hardware foundation for developing the C programming language and early UNIX systems. It supported multiple operating systems like RT-11, RSX-11, and UNIX, which directly shaped modern OS design principles. With over 600,000 units sold, the PDP-11 is celebrated as one of its era's most versatile and influential "minicomputers".

Check out the wikipedia page for some great history, photos (pictured here), and more -

And here's a story from Adafruit team member, Bill!

The DEC PDP-11 was the one of the first computers I ever programmed. That program was 'written' with a soldering iron.

I was an art student at the time, but spending most of my time in the engineering labs. There was a PDP-11-34 in the automation lab connected to an X-ray spectroscopy machine. Starting up the machine required toggling in a bootstrap loader via the front panel. This was a tedious process. So we ordered a diode-array boot ROM which had enough space to program 32 sixteen bit instructions.

Each instruction in the boot sequence needed to be broken down into binary (very straightforward with the PDP-11 instruction set). For each binary '1', a diode needed to be soldered into the array. The space was left empty for each '0'. 32 sixteen bit instructions was more than sufficient to load a secondary bootstrap from the floppy disk to launch the RT-11 operating system. So now it was possible to boot the system with just the push of a button.

I worked with a number DEC PDP-11/LSI-11 systems over the years. I still keep an LSI-11-23 system around for sentimental reasons.

Have first computer memories? Post’em up in the comments, or post yours on socialz’ and tag them #firstcomputer #retrocomputing – See you back here tomorrow!

#dec#pdp11#retrocomputing#adventcalendar#minicomputer#unixhistory#cprogramming#computinghistory#vintagecomputers#modulardesign#scalablehardware#digitalcorporation#engineeringlabs#programmingroots#oldschooltech#diodearray#bootstraploader#firstcomputer#retrotech#nerdlife

290 notes

·

View notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Axolt: Modern ERP and Inventory Software Built on Salesforce

Today’s businesses operate in a fast-paced, data-driven environment where efficiency, accuracy, and agility are key to staying competitive. Legacy systems and disconnected software tools can no longer meet the evolving demands of modern enterprises. That’s why companies across industries are turning to Axolt, a next-generation solution offering intelligent inventory software and a full-fledged ERP on Salesforce.

Axolt is a unified, cloud-based ERP system built natively on the Salesforce platform. It provides a modular, scalable framework that allows organizations to manage operations from inventory and logistics to finance, manufacturing, and compliance—all in one place.

Where most ERPs are either too rigid or require costly integrations, Axolt is designed for flexibility. It empowers teams with real-time data, reduces manual work, and improves cross-functional collaboration. With Salesforce as the foundation, users benefit from enterprise-grade security, automation, and mobile access without needing separate platforms for CRM and ERP.

Smarter Inventory Software Inventory is at the heart of operational performance. Poor inventory control can result in stockouts, over-purchasing, and missed opportunities. Axolt’s built-in inventory software addresses these issues by providing real-time visibility into stock levels, warehouse locations, and product movement.

Whether managing serialized products, batches, or kits, the system tracks every item with precision. It supports barcode scanning, lot and serial traceability, expiry tracking, and multi-warehouse inventory—all from a central dashboard.

Unlike traditional inventory tools, Axolt integrates directly with Salesforce CRM. This means your sales and service teams always have accurate availability information, enabling faster order processing and better customer communication.

A Complete Salesforce ERP Axolt isn’t just inventory software—it’s a full Salesforce ERP suite tailored for businesses that want more from their operations. Finance teams can automate billing cycles, reconcile payments, and manage cash flows with built-in modules for accounts receivable and payable. Manufacturing teams can plan production, allocate work orders, and track costs across every stage.

86 notes

·

View notes

Text

Dandelion News - October 8-14

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles on Patreon!

1. All 160 dogs at Florida shelter found homes ahead of Hurricane Milton

“[The shelter] offered crates, food and anything else the dogs would need in exchange for the animals to spend just five days with the foster parents if the human didn't want to keep them for longer. […A]fter about a day of receiving around 100 messages every 30 minutes, Bada said, all 160 were gone from the shelter and in safe and warm homes.”

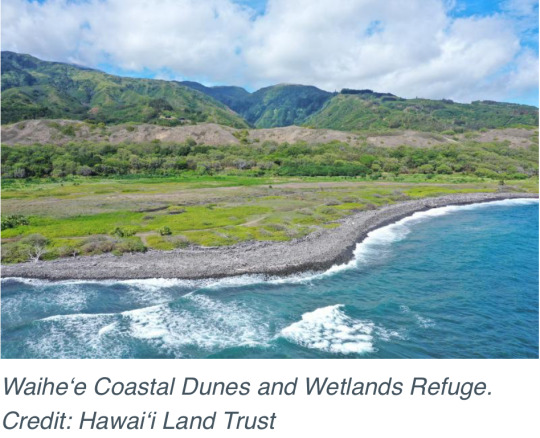

2. Restoring Ecosystems and Rejuvenating Native Hawaiian Traditions in Maui

“[Volunteers] are restoring water flow to the refuge, removing invasive species, and restoring a loko iʻa kalo using ʻike kūpuna, ancestral knowledge. […] This human-made ecosystem will provide food for community members and habitat for wildlife while protecting coral reefs offshore.”

3. Solar-powered desalination system requires no extra batteries

“In contrast to other solar-driven desalination designs, the MIT system requires no extra batteries for energy storage, nor a supplemental power supply, such as from the grid. […] The system harnessed on average over 94 percent of the electrical energy generated from the system’s solar panels to produce up to 5,000 liters of water per day[….]”

4. Threatened pink sea fan coral breeds in UK aquarium for first time

“The spawning is part of University of Exeter Ph.D. student Kaila Wheatley Kornblum's research into the reproduction, larval dispersal and population connectivity of Eunicella verrucosa. […] Pink sea fans are believed to have been successfully bred by only one other institution, Lisbon Oceanarium, in 2023.”

5. Tiny 'backpacks' are being strapped to baby turtles[….]

““We analysed the data and found that hatchlings show amazingly consistent head-up orientation – despite being in the complete dark, surrounded by sand [… and] they move as if they were swimming rather than digging[…. This new observation method is] answering questions about best conservation practices,” says Dor.”

6. New California Law Protects Wildlife Connectivity

“A new state law in California will instruct counties and municipalities to conserve wildlife corridors when planning new development. […] This could entail everything from creating wildlife crossings at roads or highways, employing wildlife-safe fencing, or not developing on certain land.”

7. ‘I think, boy, I’m a part of all this’: how local heroes reforested Rio’s green heart

“By 2019, [the program] had transformed the city’s landscape, having trained 15,000 local workers like Leleco, who have planted 10m seedlings across […] roughly 10 times the area of New York’s Central Park. Reforested sites include mangroves and vegetation-covered sandbars called restinga, as well as wooded mountainsides around favelas.”

8. Alabama Town Plans to Drop Criminal Charges Over Unpaid Garbage Bills

““Suspending garbage pickup, imposing harsh late penalties and prosecuting people who through no fault of their own are unable to pay their garbage and sewage bills does not make payment suddenly forthcoming,” West said. [… The city] has agreed to drop pending criminal charges against its residents over unpaid garbage bills.”

9. New Hampshire’s low-income community solar program finally moves forward

“The state energy department is reviewing seven proposals for community solar arrays that will allocate a portion of their bill credits to low-income households. […] New Hampshire’s strategy of working with utilities to automatically enroll households that have already been identified streamlines the process.”

10. The Future Looks Bright for Electric School Buses

“EPA has awarded about $3 billion in grants from the infrastructure law, which paid to replace about 8,700 buses. Of those, about 95 percent are electric. [… Electric buses are] cheaper to operate and require less maintenance than diesel buses and will soon be at cost parity when looking at the lifetime cost of ownership[….]”

October 1-7 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#dogs#hurricane milton#florida#animal shelters#foster dog#hawaii#hawaiʻi#maui#solar#water#solar energy#coral#endangered species#coral reef#turtles#sea turtle#technology#wildlife#habitat#nature#california#rio#south america#reforestation#poverty#anti capitalism#solar panels#electric vehicles

200 notes

·

View notes

Text

Politics

Republicans propose gutting Biden climate bill for Trump tax cuts

By Seiji Yamashita, Tracy J. Wholf

May 15, 2025 / 12:31 AM EDT / CBS News

House Republicans Wednesday moved forward with a tax bill to cut billions of dollars in climate-related funding, reduce regulations and prematurely phase out clean energy tax credits as part of President Trump's "One, Big, Beautiful Bill."

The heart of the Republican budget legislation targets key climate and energy provisions of the Inflation Reduction Act.

Cuts would impact businesses and consumers, affecting renewable energy, manufacturing, energy efficiency and electric vehicles. Concurrently, House Republicans proposed streamlining permitting for fossil fuels, rescinding Clean Air Act pollution funding and allocating $2 billion to the strategic petroleum reserve.

The Inflation Reduction Act has led to $321 billion worth of climate investment being completed, with $522 billion worth of investments still in process, according to a report from the Clean Investment Monitor. Congress was tasked with finding $1.5 trillion in spending cuts to fund Mr. Trump's tax cuts.

House Republicans are hoping to have a floor vote next week prior to Memorial Day, after which the bill will go to the Senate.

94 notes

·

View notes

Text

Things Biden and the Democrats did, this week #9

March 9-15 2024

The IRS launched its direct file pilot program. Tax payers in 12 states, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California and New York, can now file their federal income taxes for free on-line directly with the IRS. The IRS plans on taking direct file nation wide for next year's tax season. Tax Day is April 15th so if you're in one of those states you have a month to check it out.

The Department of Education’s Office of Civil Rights opened an investigation into the death of Nex Benedict. the OCR is investigating if Benedict's school district violated his civil rights by failing to protect him from bullying. President Biden expressed support for trans and non-binary youth in the aftermath of the ruling that Benedict's death was a suicide and encouraged people to seek help in crisis

Vice President Kamala Harris became the first sitting Vice-President (or President) to visit an abortion provider. Harris' historic visit was to a Planned Parenthood clinic in St. Paul Minnesota. This is the last stop on the Vice-President's Reproductive Rights Tour that has taken her across the country highlighting the need for reproductive health care.

President Biden announced 3.3 billion dollars worth of infrastructure projects across 40 states designed to reconnect communities divided by transportation infrastructure. Communities often split decades ago by highways build in the 1960s and 70s. These splits very often affect communities of color splitting them off from the wider cities and making daily life far more difficult. These reconnection projects will help remedy decades of economic racism.

The Biden-Harris administration is taking steps to eliminate junk fees for college students. These are hidden fees students pay to get loans or special fees banks charged to students with bank accounts. Also the administration plans to eliminate automatic billing for textbooks and ban schools from pocketing leftover money on student's meal plans.

The Department of Interior announced $120 million in investments to help boost Climate Resilience in Tribal Communities. The money will support 146 projects effecting over 100 tribes. This comes on top of $440 million already spent on tribal climate resilience by the administration so far

The Department of Energy announced $750 million dollars in investment in clean hydrogen power. This will go to 52 projects across 24 states. As part of the administration's climate goals the DoE plans to bring low to zero carbon hydrogen production to 10 million metric tons by 2030, and the cost of hydrogen to $1 per kilogram of hydrogen produced by 2031.

The Department of Energy has offered a 2.3 billion dollar loan to build a lithium processing plant in Nevada. Lithium is the key component in rechargeable batteries used it electric vehicles. Currently 95% of the world's lithium comes from just 4 countries, Australia, Chile, China and Argentina. Only about 1% of the US' lithium needs are met by domestic production. When completed the processing plant in Thacker Pass Nevada will produce enough lithium for 800,000 electric vehicle batteries a year.

The Department of Transportation is making available $1.2 billion in funds to reduce decrease pollution in transportation. Available in all 50 states, DC and Puerto Rico the funds will support projects by transportation authorities to lower their carbon emissions.

The Geothermal Energy Optimization Act was introduced in the US Senate. If passed the act will streamline the permitting process and help expand geothermal projects on public lands. This totally green energy currently accounts for just 0.4% of the US' engird usage but the Department of Energy estimates the potential geothermal energy supply is large enough to power the entire U.S. five times over.

The Justice for Breonna Taylor Act was introduced in the Senate banning No Knock Warrants nationwide

A bill was introduced in the House requiring the US Postal Service to cover the costs of any laid fees on bills the USPS failed to deliver on time

The Senate Confirmed 3 more Biden nominees to be life time federal Judges, Jasmine Yoon the first Asian-America federal judge in Virginia, Sunil Harjani in Illinois, and Melissa DuBose the first LGBTQ and first person of color to serve as a federal judge in Rhode Island. This brings the total number of Biden judges to 185

#Thanks Biden#Joe Biden#Democrats#politics#US politics#good news#nex benedict#abortion#taxes#climate change#climate action#tribal communities#lithium#electronic cars#trans rights#trans solidarity#judges

367 notes

·

View notes

Text

Jessica Valenti at Abortion, Every Day:

Well this is a nightmare: A new Missouri bill would create a state-run registry of pregnant women the government deems “at risk for seeking an abortion.” If tracking pregnant women wasn’t dystopian enough, the Republican-sponsored legislation would also give people interested in adopting babies access to this registry—because what’s more on brand for Republicans than turning pregnancy into a state-monitored marketplace? “We’re looking at something like e-Harmony for babies,” adoption attorney Gerard Harms told the House Children and Families Committee. Harms apparently worked on the bill alongside its sponsor, Rep. Phil Amato. I don’t think I need to explain why this is terrifying. Missouri Republicans are proposing a government database to track pregnant women they suspect might want an abortion. But how would the state decide who makes the list? What qualifies someone as “at risk of seeking an abortion”? And why in the ever-loving fuck would they hand over these women’s information to anyone?

If the premise isn’t chilling enough, the fine print makes it even worse. The bill appears to clear the way for anti-abortion crisis pregnancy centers to run the registry: House Bill 807 states that Missouri will hire outside “contractors” to run the system—specifically ones with a “proven record of providing resources to expectant mothers and children.” Sound familiar? Crisis pregnancy centers (CPCs) already receive millions in funding from Republican-led states, prey on vulnerable women, and have deep ties to evangelical adoption agencies. Many also run ‘maternity homes’—residential facilities that seek to shame and control pregnant women, and pressure them into terminating their parental rights. And let’s not forget: Republicans in multiple states are also pushing to “streamline” adoption processes, aka making it easier for the state to terminate people’s parental rights.

Meanwhile, these centers have a long history of tracking and misusing women’s data. It wasn’t long ago that Abortion, Every Day revealed how Heartbeat International—the country’s largest network of crisis pregnancy centers—was lying to women about how their personal information was being stored and shared. Knowing all of the above, I’ll tell you what this Missouri bill sounds like to me: Republicans creating a system that targets vulnerable pregnant people they deem “unfit,” coercing them into giving birth and surrendering their parental rights, then placing their children with families it considers more ‘worthy.’ I think we all know the race and class implications here, too. What’s more, the bill also says that the groups offering these services “shall have qualified immunity from civil liability for providing such services.” In other words, they could track, manipulate, and exploit pregnant women without fear of lawsuits. Policy attempts like this are nothing new: We’ve watched Republicans like then-Senator Marco Rubio push for a state-run website to collect data on pregnant women—all while claiming to 'help women.'

Anti-abortion bill Missouri HB807 is about the creation of a state-run registry of pregnant women.

See Also:

Fox2now: Missouri bill proposes registry for pregnant mothers

#Missouri HB807#Missouri#Abortion#Pregnancy#Phil Amato#Anti Abortion Extremism#Privacy#Pregnancy Monitoring

81 notes

·

View notes

Text

Hey Californians! This bill is due to be voted on this year, and health insurance corporations and other such interests are going to fight it BIG TIME. I expect many, many, many misleading ads about it. Probably the kind of ads where they say it will make costs go up. That's corporations favorite lie. Their go-to, if you will.

HOWEVER, this is a bill to protect the health care and rights of patients to be treated promptly according to what they and their doctor require, not what an insurance company says.

Things included in this bill:

SB 351 by Senator Christopher Cabaldon (SD 3): Private equity firms are gaining influence in our health care system, leading to rising costs and undermining the quality of care. SB 351 empowers the Attorney General to hold private equity groups accountable for interfering with the practice of medicine, allowing the Attorney General to investigate and take action against private equity firms that unlawfully interfere in the patient-physician relationship. The goal is to restore trust in the health care system, ensuring that medical decisions are made in the best interest of patients, not financial shareholders.

AB 489 by Assemblymember Mia Bonta (AD 18): While AI can be a useful tool in health care, it should not replace physician decision making. This bill would ban companies from marketing artificial intelligence (AI) chatbots as licensed medical professionals.

SB 32 by Senator Akilah Weber Pierson (SD 39): California is facing a maternity care crisis, with at least 56 hospitals shutting down or suspending labor and delivery services since 2012. This bill would enhance access to maternity care services by requiring the Department of Health Care Services (DHCS), the Department of Manage Health Care (DMHC), and the California Department of Insurance (CDI) to establish time and distance standards for perinatal units in collaboration with stakeholders.

AB 967 by Assemblymember Avelino Valencia (AD 68): California is facing a physician shortage, leaving millions of residents waiting weeks and months to get critical care. This bill will streamline the process for licensing out-of-state physicians looking to practice in California.

Additionally, CMA is sponsoring a bill package entitled “Prioritizing Patients, Empowering Physicians” to cut bureaucracy in the health system that harms patients and delays the ability to provide care. The red tape, called prior authorization, has been shown to unnecessarily delay care and lead to serious adverse events such as hospitalizations, permanent bodily damage and even death. The Prioritizing Patients, Empowering Physicians package includes:

AB 510 by Assemblymember Dawn Addis (AD 30): Requires that appeals of prior authorization denials be performed by a provider of the same or similar specialty. This will help ensure that providers can discuss prior authorization denials with a professional peer who understands the recommended treatment and underlying condition.

AB 539 by Assemblymember Pilar Schiavo (AD 40): Extends the validity of an approved prior authorization to one year (current industry standard is 60 to 90 days). This will provide patients with a longer window of time to receive medically necessary care and avoid the cumbersome prior authorization review and appeal processes.

AB 512 by Assemblymember John Harabedian (AD 41): Requires health plans to respond to urgent prior authorization requests within 24 hours and respond to nonurgent requests within 48 hours. Currently, health plans have 72 hours for urgent requests and five days for nonurgent requests. This change will ensure more patients can receive care or appeal denials in a timely fashion.

SB 306 Senator Josh Becker (SD 13): Requires health plans to remove the requirement for prior authorization from any service that they approve more than 90% of the time. This will reduce the overall volume of prior authorization requests and ensure that patients can receive the care they need with minimal delay and physicians can spend more time focusing on patient care.

So, I need to share this and keep sharing it, and I would love it if everyone started bringing this up to their possibly confused relatives and coworkers *now*. Waaaay ahead of the ads that are going to start airing. We are going to educate and inoculate people before they ever get to see those ads.

And yes, also mention that the health insurance companies are going to create orgs without their names on them to pay for those ads. When you see a political ad and it says "paid for by" at the bottom... those organizations are usually just fronts for corporations or special interest groups. And they LIE to save themselves money.

We are beating them to the punch by spreading the truth first.

42 notes

·

View notes

Photo

Fugitive Slave Act of 1850: Northern Resistance and Tubman's Rescue of Charles Nalle

The Fugitive Slave Act of 1850 (1850-1864) was part of the Compromise of 1850, drafted to diffuse tensions between Southern 'slave states' and Northern 'free states.' The Fugitive Slave Act of 1793 already allowed slaveholders to reclaim their fugitive slaves from Northern states, but, since many Northerners were not inclined to help them in this, the 1793 law had little real power. Although one could be punished for not complying with the 1793 law, Northern police officers could refuse to make an arrest, and Northern judges could dismiss a case, as many saw the 'law' as legalized kidnapping. The Fugitive Slave Act of 1850 compelled Northern authorities, law enforcement, and ordinary citizens to report on fugitives and help slave catchers retrieve them.

The Fugitive Slave Act of 1850 (as with the law of 1793) was extremely unpopular in the North. People who had never had to give much thought to the issue of slavery were now being forced to participate in it or face six months in prison and a fine of $1,000.00 (roughly $37,000.00 today). Many people in the North continued to shelter and help fugitive slaves (freedom seekers), and some, like Harriet Tubman (circa 1822-1913), took direct action in challenging the law.

In spring 1860, while visiting a cousin in Troy, New York, Tubman heard that a freedom seeker named Charles Nalle had been found by his master (who was also his brother) and would be deported back to the South. Tubman instantly took action, and her dramatic rescue of Nalle has become one of the best-known from her days as a conductor on the Underground Railroad. The response of the crowd supporting Tubman's rescue is also famous as a clear example of Northern resistance to the Fugitive Slave Act of 1850.

The Fugitive Slave Act of 1850

The Fugitive Slave Act of 1850 was one of the five bills introduced by Senator Stephen A. Douglas (1813-1861) as the Compromise of 1850. Douglas' legislation was a reworking of an earlier compromise introduced by Senator Henry Clay (1777-1852) of Kentucky. Douglas' version streamlined Clay's original eight resolutions down to five bills, all to be voted on separately, and these were passed by the US Congress in 1850. Section 3 of the Fugitive Slave Act of 1850 addresses the responsibilities of authorities and law enforcement in apprehending freedom seekers, while Section 7 gives notice to citizens of Northern states what was expected of them and the punishment they would suffer for non-compliance:

And be it further enacted, That any person who shall knowingly and willingly obstruct, hinder, or prevent such claimant, his agent or attorney, or any person or persons lawfully assisting him, her, or them, from arresting such a fugitive from service or labor, either with or without process as aforesaid, or shall rescue, or attempt to rescue, such fugitive from service or labor, from the custody of such claimant, his or her agent or attorney, or other person or persons lawfully assisting as aforesaid, when so arrested, pursuant to the authority herein given and declared; or shall aid, abet, or assist such person so owing service or labor as aforesaid, directly or indirectly, to escape from such claimant, his agent or attorney, or other person or persons legally authorized as aforesaid; or shall harbor or conceal such fugitive, so as to prevent the discovery and arrest of such person, after notice or knowledge of the fact that such person was a fugitive from service or labor as aforesaid, shall, for either of said offences, be subject to a fine not exceeding one thousand dollars, and imprisonment not exceeding six months, by indictment and conviction before the District Court of the United States for the district in which such offence may have been committed, or before the proper court of criminal jurisdiction, if committed within any one of the organized Territories of the United States; and shall moreover forfeit and pay, by way of civil damages to the party injured by such illegal conduct, the sum of one thousand dollars for each fugitive so lost as aforesaid, to be recovered by action of debt, in any of the District or Territorial Courts aforesaid, within whose jurisdiction the said offence may have been committed.

(American Battlefield Trust, Section 7)

The Federal Government of the United States was now actively engaged in slave-catching, which, to many in the North, it had no business participating in. Once the Act was signed into law, however, even those actively opposed to slavery were expected to support it, creating an atmosphere of hostility and fear that further polarized the free and slave states, escalating tension in the years leading up to the American Civil War, as scholar Andrew Delbanco notes:

It was an act without mercy. To those arrested under its authority, it denied the most basic right enshrined in the Anglo-American legal tradition: habeas corpus – the right to challenge, in open court, the legality of their detention. It forbade defendants to testify in their own defense. It ruled out trial by jury. Except for proof of freedom, such as emancipation papers signed by a former owner, the Fugitive Slave Act disallowed all forms of exonerating evidence, including evidence of beatings, rape, or other forms of abusee while the defendant had been enslaved.

It criminalized the act of sheltering a fugitive and required local authorities to assist the claimant in recovering his lost human property…Everything about the Fugitive Slave Act favored the slave owners. Even free black people in the North – including those who had never been enslaved – found their lives infused with the terror of being seized and deported on the pretext that they had once belonged to someone in the South.

(5)

Even so, many abolitionists defied the law – such as William Still (1819-1902) and Passmore Williamson (1822-1895), who, in 1855, participated in the liberation of Jane Johnson and her two children in Philadelphia. Harriet Tubman, as seen below, also refused to comply with the Fugitive Slave Act of 1850, and, as noted, so did the crowd she assembled to help her in freeing Charles Nalle in Troy, New York, in 1860.

The Fugitive Slave Act of 1850 remained on the books until it was repealed in June 1864, toward the end of the American Civil War (1861-1865). In 1865, slavery was abolished by the Thirteenth Amendment.

Read More

⇒ Fugitive Slave Act of 1850: Northern Resistance and Tubman's Rescue of Charles Nalle

36 notes

·

View notes